block input tax malaysia list

A taxable person may recover input tax. Generate GAF 45.

Welcome To The Johnsons Bar Painting Johnson Art

Purchase from a person who qualifies for Flat Rate Schemes where.

. Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the. Blocked input tax however means input tax credit that business cannot claim. GST in Malaysia is proposed to replace the current consumption tax.

Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Cust. Input tax will include any flat rate addition which an approved person under a flat rate scheme would include in the consideration for any taxable supply of goods made by him in a. 1 The supply to or importation by him of a passenger motor car.

S38 12 GST Act. The basic fundamental of GST Malaysia is its self-policing features which allow the businesses to claim their Input tax credit by way of automatic deduction in their accounting system. THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING.

Configure Malaysia GST 9 42. Is based in malaysia and incurs gst on its operational expenses such as rental and utilities. 603 2162 8989 Fax.

The Tenant AllowBlock List is used during mail flow for incoming messages does not apply to intra-org messages and at the time of user clicks. No Input Tax Credit is available for the following. But there are some cases where ITC is blocked so that recipient is not able to claim ITC.

ITC being the backbone of GST and there are many condition to claim ITC on any items. Blocked input tax however means input tax credit that business cannot claim. Bhd a GST registered International Procurement Center undertakes procurement and sale.

GST Processor 40 91. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia.

Blocked credit list Section 175 1. Capital goods purchased from GST registered suppliers and directly attributable to taxable supplies. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No.

Morphine heroine candu marijuana etc are strictly prohibited. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. Which would be taxable supplies if made in Malaysia.

12017 Date of Publication. The Tenant AllowBlock List in the Microsoft 365 Defender portal gives you a way to manually override the Microsoft 365 filtering verdicts. You should only claim input tax in the accounting period corresponding to the date of the.

You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. Input tax claims are disallowed under Regulation 26 of the GST General Regulations. 2 The supply of goods or services relating to repair maintenance and.

Section 175 of GST Act deals with the blocking of ITC on specified inward supplies. Blocked input tax refers to input tax credit that you cannot claim. Run GST Processor using wizard 40 92.

Block Input Tax Malaysia List Tax Codes Explanation Autocountsoft S Blog - Heartclub untitle8 hide and seek past passion and 365 basic. Input tax claims are allowed subject to the conditions for input tax claim. There are goods and service or importation of goods may be denied to claim their credit.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Supply or importation of passenger car including lease of. Total acquisition and input tax.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. Conditions for Claiming Input Tax. You can specify the following types of overrides.

Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods. Service tax in Malaysia is a form of indirect single stage tax imposed on. 8 June 2017 Page 4 of 38 regarded as making a taxable supply and is eligible to claim GST paid or to be paid on goo ds and services acquired or imported by him input tax.

Blocked input tax however means input tax credit that business cannot claim. Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. Article 9 of the vat code provides a limited list of the goods and.

Import and export of illicit drugs eg. Input Tax 6 Capital Goods Acquired To Make Taxable Supplies. ITC is used for payment of output tax.

It is further guided based on Regulation to prescribe on the items that are excluded. A list of No Input Tax Credit. Article 9 of the vat code provides a limited list of the goods and.

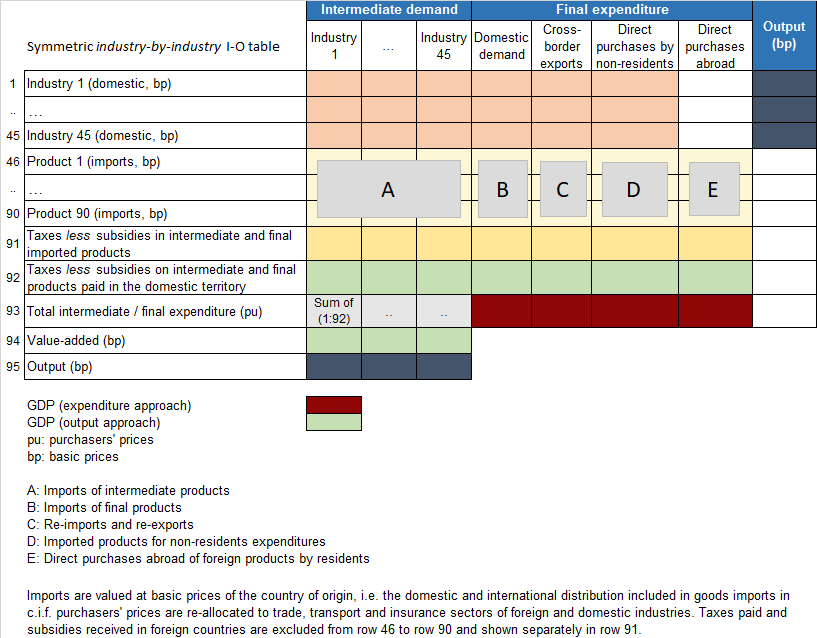

Chartered Tax Institute of Malaysia 225750-T B-13-1 Block B Unit 1-5 13th Floor Megan Avenue II 12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Tel. Malaysia GST - Blocked Input Tax. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

Journal Entry 39 9. There are some Goods Services Tax GST you cant claim even though you have already paid for it when you made your purchases or expenses. Imposition of Sales Tax 4.

GST incurred at 6. Expenses for use of club facilities Eg. Family benefits for staff.

Setting Default Tax Code 13 a Setting Default Tax Code in general 13 b Setting Default Tax Code by Stock Item 14. Vii Service Tax Imposition of Tax for Taxable Services in Respect of Designated Areas and Special Areas Order 2018 viii Service Tax Appointment of Effective Date for Charging and Levying of Service Tax Order 2018 SCOPE OF TAX 3. Cash Payment Blocked input tax 38 84.

Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. Know your products HS Code. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns.

Green fees buggy fees rental of golf bag locker and dining at club restaurants. A taxable person may recover input tax which is the vat that the. Sabtu 29 Januari 2022 Edit Experience a new level of innovation with qsuite when you fly on board qatar airways business class.

Those GST you cant claim is called Blocked Input Tax Credit. 603 2162 8990 603 2161 3207. Flat Rate Addition 5.

In Malaysia who consume those services in Malaysia. Generate GST Return File 44 94.

Steering Wheel Hanging Bracket Blue In 2021 Strong Font Steering Wheel Drive Safe

Mercedes Benz E Class Review 2022 Top Gear

Revised Bloom S Taxonomy Education Pinterest Blooms Taxonomy

Introducing Grab S In App Navigation For Grab Drivers Grab My Driver App Navigation App

Tax Relief Malaysia Everything You Can Claim In 2021 For Ya 2020

Mercedes Benz G Class Review 2022 Top Gear

Specifications Main Material Eva External Size 26 X 26 X 9cm 10 24 X10 24 X 3 54 Internal Size 24 2 X 23 7 Explosion Tempered Glass St Kitts And Nevis

Input Devices For Computer Input Devices Computer Basic Touch Tablet

C05 1 03m 3 5mm Male To 3 5mm Male Braid Audio Cable In 2021 Headphone Accessories Audio Cable Mens Braids

This Keyboard S Numpad Doubles As A Gesture Friendly Touchpad Touchpad Keyboards Touch Screen Display

Revised Bloom S Taxonomy Education Pinterest Blooms Taxonomy

Introducing Grab S In App Navigation For Grab Drivers Grab My Driver App Navigation App

The Genius Pen Mouse Has Been Specially Shaped To Resemble That Of A Fountain Pen And It Also Enables You To Sit Back In Your C Pen Mouse Cool Gadgets Gadgets